Financial Resources

At the Norwalk Business Development Center we are here to help. Whether it be with education, accessing capital, state registration, or permitting and licensing we are here to help. Don’t hesitate to call us at 203-854-7948 or drop in for a visit. We are open from 9am to 4pm at 3 Belden Avenue!

Workforce Development Are you interested in learning more about workforce development opportunities in Norwalk? Norwalk ACTS, in partnership with the City of Norwalk & Greater Norwalk Chamber, recently launched a monthly newsletter for youth and residents to learn about local updates and opportunities. Subscribe now!

Workforce Development Are you interested in learning more about workforce development opportunities in Norwalk? Norwalk ACTS, in partnership with the City of Norwalk & Greater Norwalk Chamber, recently launched a monthly newsletter for youth and residents to learn about local updates and opportunities. Subscribe now!

Hiring & Training Resources Norwalk has a significant amount of resources designated to technical support on hiring staff for your business. We have direct access to workforce pools and can even help you create a certificate program to train Norwalk residents for available jobs. Contact Norwalk ACTS for more information info@norwalkacts.org.

The Norwalk Innovations Initiative has been established to provide entrepreneurs, start-ups, and existing businesses with grant funding to support initial establishment, expansion efforts, and growth within the City of Norwalk. Limited, one-time financial assistance will be available to Norwalk entrepreneurs, start-ups, and existing businesses that employ or plan to employ between 2 and 50 individuals. The initiative is funded through both capital funds and American Rescue Plan Act Funds that have been allocated to the City of Norwalk. The goals of the initiative are to support entrepreneurs, start-ups, and existing businesses and decrease vacancy rates and decrease unemployment rates. For complete program guidelines, click here.

For 2024, the Innovations Program has $100,000 available to support our local small businesses with grants. Applications are being accepted now through February 16th. Click here or scan the QR code to apply online.

For 2024, the Innovations Program has $100,000 available to support our local small businesses with grants. Applications are being accepted now through February 16th. Click here or scan the QR code to apply online.

Successful applicants will be invited to participate in a pitch event where the applicants will be asked to present their business plan and use of funds, should they be awarded, to a team of judges.

If you have any additional questions or need assistance with your application, please don’t hesitate to reach out to Sabrina Godeski, Director of Business Development and Tourism, at sgodeski@norwalkct.gov or 203-854-7948.

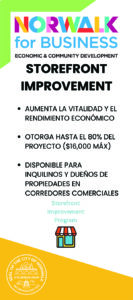

The purpose of the Storefront Improvement Program is to encourage businesses and property owners within commercial corridors to improve the front exterior of their commercial properties, making these areas more attractive to shoppers and growing their vitality and economic performance. City of Norwalk property owners or tenants can access financial resources to renovate or restore commercial building exterior facades through the Storefront Improvement Program. A total of $50,000 of grant funding will be available each year and expenses are matched at 80%. Visit here for program guidelines and more information.

For questions, or to apply, fill and print and email to sgodeski@norwalkct.gov.

Many Fairfield County small business owners experience barriers to obtaining credit or loans needed to grow their businesses. This is particularly true for Black, Indigenous and People of Color (BIPoC) entrepreneurs living in neighborhoods with lower to middle incomes. In an effort to support these small business owners, the Community Foundation has partnered with Honeycomb Credit, an innovative platform for eligible small businesses to borrow funds from their customers, community members, and Fairfield County’s Community Foundation (FCCF). FCCF has committed $200,000 to this community investing pilot program. Business owners with a capital need of $25,000 or more are encouraged to apply and benefit from an initial investment of $10,000 from the Fairfield County Community Foundation. FCCF hopes small businesses throughout Fairfield County can take advantage of this innovating funding opportunity. Learn more at https://fccfoundation.org/honeycomb/.

Many Fairfield County small business owners experience barriers to obtaining credit or loans needed to grow their businesses. This is particularly true for Black, Indigenous and People of Color (BIPoC) entrepreneurs living in neighborhoods with lower to middle incomes. In an effort to support these small business owners, the Community Foundation has partnered with Honeycomb Credit, an innovative platform for eligible small businesses to borrow funds from their customers, community members, and Fairfield County’s Community Foundation (FCCF). FCCF has committed $200,000 to this community investing pilot program. Business owners with a capital need of $25,000 or more are encouraged to apply and benefit from an initial investment of $10,000 from the Fairfield County Community Foundation. FCCF hopes small businesses throughout Fairfield County can take advantage of this innovating funding opportunity. Learn more at https://fccfoundation.org/honeycomb/.

The City of Norwalk prides itself on being able to continuously be responsive to our local businesses and entrepreneurs. As a result, the City released the Small Business & Main Street Program that is continuously funded to be responsive to needs on a yearly basis. Visit here for information on this year’s funding.

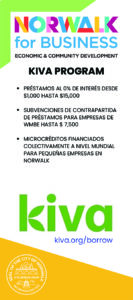

Kiva is a global nonprofit organization that provides interest-free crowdfunded microloans to local entrepreneurs. Kiva’s network of microlenders creates the first step for small businesses to move up the capital ladder. The Norwalk Kiva Hub allows entrepreneurs who may have been previously denied access to a loan an alternative way to access capital. Through the City of Norwalk’s new Kiva Hub, local businesses can access between $1,000 to $15,000 at 0% interest.

“From the beginning up to now I have nothing but positive things to say about Kiva. The whole experience was amazing, from the first conversation I had with my loan counselor. The whole process was extremely quick and simple. I am amazed and extremely grateful for everyone’s contributions. One day I will be able to help make a fellow entrepreneur’s dream come true! Thank you Kiva!” – Juliane Etienne – BAOU Apparel

“From the beginning up to now I have nothing but positive things to say about Kiva. The whole experience was amazing, from the first conversation I had with my loan counselor. The whole process was extremely quick and simple. I am amazed and extremely grateful for everyone’s contributions. One day I will be able to help make a fellow entrepreneur’s dream come true! Thank you Kiva!” – Juliane Etienne – BAOU Apparel

First in the nation to offer a statewide program of benefits to help targeted investment communities, Connecticut has greatly expanded the number of State-approved municipalities that may offer the various enterprise zone benefits—from the original 6 cities and towns in 1982, to over 45 participating municipalities in 2021.

There are 10 types of zone designations in Statutes that authorize the State and approved municipalities to offer various incentives, with goals to encourage new economic development, lower the cost of doing business in Connecticut, increase private investment, expand the local tax base, re-use underused properties, grow important industry clusters, and expand job opportunities for zone residents.

To begin the application process, fill out the Preliminary Questionnaire to Determine Eligibility.

An Opportunity Zone is a designated geography where investors can defer taxes on any prior capital gains invested in a Qualified Opportunity Fund. Qualified Opportunity Funds can invest in real estate or businesses within designated geographies. The City of Norwalk has three Opportunity Zones shown here. Both businesses and property owners within these geographies benefit by garnering additional investor pools designated for Opportunity Zones. For more information contact Sabrina Godeski, the Director of Business Development and Tourism at sgodeski@norwalkct.org.